Rates are up. How does that affect you?

We've been hovering at record low interest rates since the financial crisis in 2008. We've seen them even dip below 3% for a 30 year fixed rate for a short period in time. That is insane. When you ask my parents, who bought their first home in 1990, what their first rate was they quickly responded with "around 10%." That's high but not as high as they got in the early 80s: upwards of 19%. So even at a rate around 5% you're sitting pretty nice but obviously you still want to lock in as low as possible.

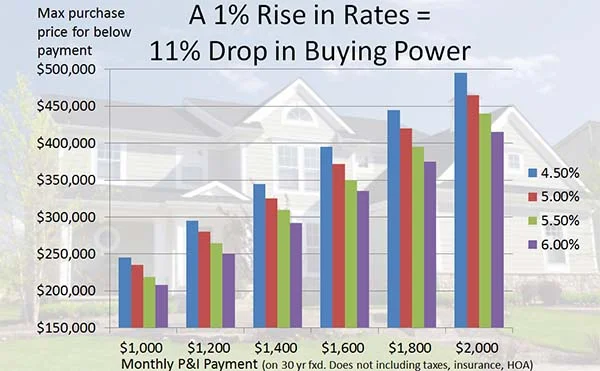

The most popular question I get is how do the raises in rates affect me if I can't buy until next fall? Well, even though we don't know exactly what the rates will do over the next year it's a safe bet they will slowly but surely increase as the fed loosens its reigns. As of today: 4.125%. By the end of the summer? Maybe 4.5%-4.625%. How does that change what you can buy? An easy chart to help explain is below. Now, I don't think we will get close to 6% but it's a good visual just to see at multiple rates and purchase points how that changes things.

A nice example: Your $300k purchase at 4.5% goes down to $280k at 5%. That's $20k less home you can buy for the same payment. That doesn't take into account an increase in market prices as a whole either. If today you can buy a 4 bed, 2 bath for $300k in the neighborhood of your choice, most likely, especially in the Twin Cities, that will be $310k by the end of the summer further lessening your buying power.

If you were thinking about buying soon, now is the time to get the most value before those rates increase! If you have more questions, hit us up at any of the locations below!